Two big trends in the gold market are running headlong into each other.

1) As I’ve been talking about for months, we’re seeing gold traders stand for physical delivery way more than the average.

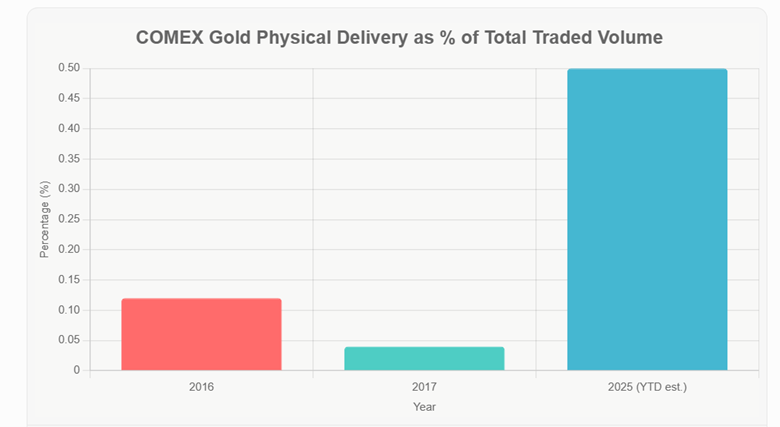

In a typical year, less than 1/10th of 1% of gold contracts on the Comex result in physical delivery.

This year, 5X as many contracts are standing for delivery. A record high. Part of the reason this number isn’t very high (relatively speaking) is that standing for delivery is not convenient or easy.

We recently saw Comex computers crash after high silver trading volume apparently overheated the system – halting trading.

The standard exchanges, simply put, are built for paper trading – not physical delivery.

There’s also regular headlines about central banks repatriating gold, or locking horns with each other about gold repatriation attempts.

A recent headline from the Euro News:

This story revealed a serious revelation for Italy and other EU member states: the gold is not Italy’s – according to Euro News. From the story:

“Gold, like foreign currency reserves, forms part of the monetary assets that underpin the credibility of the single currency and is treated as a tool of monetary stability rather than a fiscal resource.”

Hold the phone: Italy’s gold isn’t even Italy’s?

You don’t have to be an Italian or European citizen to clench your fist at the notion.

The question: “Who controls the gold?”

If it’s not in your vault or in your mine, then you might not control it.

Even if it is in your vault – (Italy supposedly has the 3rd largest gold stockpile, much of it in Italian vaults) you might not control it. Depending on where you live, it might belong to someone else…

This kind of revelation means that if you really want to secure your supply of gold for the future, you can’t rely on the good will of the folks running the vaults at the Comex or in London or China.

Which brings me to the 2nd major trend we’re seeing play out in real time in our portfolios:

2) Stablecoin and crypto firms are buying significant ownership stakes in gold miners and royalty firms.

Tether is famously buying 2 tonnes of gold per week to backstop its Tether gold holdings. It also owns a major stake in a gold royalty firm in the Golden Portfolio service.

Beating Buffett By 18,034%

Garrett Goggin’s gold royalty picks outperformed Warren Buffett’s returns by a stunning 18,034%. If you invested just $250 into the top gold royalties, it would have turned into $727,641. Now, you can get details on Garrett’s top three Gold Royalty picks – for free.

Last week, another burgeoning stablecoin firm, Streamex bought shares of another royalty firm in GP…

These firms don’t want to have to rely on physical delivery from standard, establishment-controlled exchanges. They’re building their own in-house supply chains. They’re aligning their interests with people actively mining gold.

It’s a good reminder… you are in charge of your own financial prosperity. You can’t just hope that some other entity is going to be benevolent or honorable in your favor.

There’s only one real fiduciary, and it’s the person looking at you in the mirror.

Also, at the risk of sounding like a broken record: we’re just a couple weeks away from my favorite gold company producing its first ounce of gold.

You can click here to see what’s going to happen when that first ounce gets poured…

Best,

Garrett Goggin, CFA, CMT

Lead Analyst and Founder, Golden Portfolio